Introduction: Navigating an Industry Turning Point

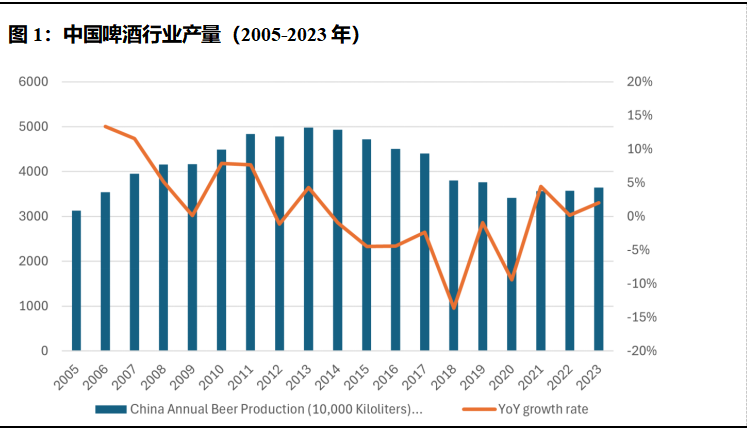

By 2016, China’s beer industry had hit a turning point. After years of rapid growth, production peaked at 50 million kiloliters in 2013. Market dynamics shifted significantly as younger consumers, particularly Gen Z, moved toward premium, experiential, and craft-style beers. Meanwhile, global beer giants like AB InBev and Heineken were aggressively expanding their premium portfolios in China, intensifying competition.

簡(jiǎn)介:引領(lǐng)行業(yè)轉(zhuǎn)折點(diǎn)

到2016年,中國(guó)的啤酒行業(yè)已經(jīng)達(dá)到了一個(gè)轉(zhuǎn)折點(diǎn)。經(jīng)過(guò)多年的快速增長(zhǎng),產(chǎn)量在2013年達(dá)到了5000萬(wàn)千升的峰值。隨著年輕消費(fèi)者,尤其是Z世代,轉(zhuǎn)向高端、體驗(yàn)式和精釀啤酒,市場(chǎng)動(dòng)態(tài)發(fā)生了顯著變化。與此同時(shí),百威英博和喜力等全球啤酒巨頭正在積極擴(kuò)大其在中國(guó)的高端投資組合,從而加劇了競(jìng)爭(zhēng)。

Figure 1. The Beer Industry Output in China (2005-2023)

Source: National Bureau of Statistics, IMD China 資料來(lái)源:中國(guó)國(guó)家統(tǒng)計(jì)局

For China Resources Beer (CR Beer), China’s largest brewer by volume, the shifting market dynamics represented not just a challenge but an existential threat. Its flagship brand, Snow Beer, had become China’s top-selling beer through scale and aggressive pricing, but this approach had become unsustainable. Internally, the company grappled with operational inefficiencies, weak positioning in the premium segment, and an aging, costly workforce—issues newly appointed CEO Hou Xiaohai called the “Three Mountains.”Source: National Bureau of Statistics, IMD China 資料來(lái)源:中國(guó)國(guó)家統(tǒng)計(jì)局

對(duì)于中國(guó)銷量最大的啤酒釀造商華潤(rùn)啤酒來(lái)說(shuō),不斷變化的市場(chǎng)動(dòng)態(tài)不僅是一個(gè)挑戰(zhàn),而且是一個(gè)生存的威脅。它的旗艦品牌“雪花”,通過(guò)規(guī)模擴(kuò)張和積極的價(jià)格策略,已經(jīng)成為中國(guó)最暢銷的啤酒,但這種方法已經(jīng)變得不可持續(xù)。在內(nèi)部,該公司努力應(yīng)對(duì)運(yùn)營(yíng)效率低下、在高端領(lǐng)域份額薄弱以及員工老齡化、高成本的問(wèn)題。新任命的首席執(zhí)行官侯孝海稱之為“三座大山”。

Hou understood that that transformation was essential, believing that:

"Transformation is about adapting to new consumer trends, industry cycles, and societal shifts. To succeed, companies must align with changing consumer behaviors and economic realities".

This insight became the cornerstone of CR Beer’s ambitious “3+3+3” nine-year strategy, initiated in 2017 under Hou’s leadership. Designed as a phased transformation, the strategy aimed to systematically address the company’s core challenges while building long-term competitiveness. It would prove to be a defining journey for both CR Beer and Hou Xiaohai himself.

侯孝海明白在這種情形下,變革是必要的,他相信:

“變革是為了適應(yīng)新的消費(fèi)者趨勢(shì)、行業(yè)周期和社會(huì)轉(zhuǎn)變。要想取得成功,公司必須與不斷變化的消費(fèi)者偏好和當(dāng)下的經(jīng)濟(jì)現(xiàn)實(shí)保持一致。”

這一見(jiàn)解最終演變成為華潤(rùn)啤酒雄心勃勃的“3+3+3”戰(zhàn)略,該戰(zhàn)略于2017年在侯孝海的領(lǐng)導(dǎo)下啟動(dòng)。該戰(zhàn)略設(shè)計(jì)為分階段轉(zhuǎn)型,旨在系統(tǒng)地解決公司的核心挑戰(zhàn),同時(shí)建立長(zhǎng)期競(jìng)爭(zhēng)力。這將被證明是華潤(rùn)啤酒和侯孝海本人的一個(gè)非常關(guān)鍵的決策。

Laying the Foundation: Structural and Cultural Reset

Before pursuing further growth, CR Beer recognized the necessity of addressing fundamental inefficiencies and aligning its corporate culture. Reinventing a strong brand first requires building a robust foundation through capacity optimization and organizational restructuring.

堅(jiān)實(shí)基礎(chǔ):組織與文化重塑

在追求進(jìn)一步的增長(zhǎng)之前,華潤(rùn)啤酒認(rèn)識(shí)到首先要從根本上解決效率低的問(wèn)題并開(kāi)展企業(yè)文化重塑的必要性。重塑強(qiáng)勢(shì)品牌首先需要通過(guò)能力優(yōu)化和組織重塑建立堅(jiān)實(shí)的基礎(chǔ)。

In 2017, Hou convened 100 senior executives at CR University’s Xiaojingwan Campus, initiating an ambitious restructuring. The company streamlined its operations, consolidating breweries from 98 to 63, significantly reducing inefficiencies and boosting productivity. Workforce optimization reduced headcount from 58,200 to 25,000, accompanied by a 47% wage increase to retain essential talent. Concurrently, CR Beer launched a digital overhaul, led by Guo Hua, a former IBM and Accenture executive, to enhance supply chains, intelligent manufacturing, and digital marketing capabilities.

2017年,侯孝海在華潤(rùn)大學(xué)小徑灣校區(qū)召集了100名高管,啟動(dòng)了這個(gè)雄心勃勃的計(jì)劃。該公司精簡(jiǎn)了組織,將啤酒廠從98家整合到63家,顯著改善了低效問(wèn)題,提高了生產(chǎn)率。將員工人數(shù)從58200人減少到25000人,同時(shí)工資增加47%,以留住優(yōu)秀人才。與此同時(shí),華潤(rùn)啤酒發(fā)起了一項(xiàng)由IBM和埃森哲前高管郭華領(lǐng)導(dǎo)的數(shù)智化改革,以增強(qiáng)供應(yīng)鏈、智能制造和數(shù)字營(yíng)銷能力。

Hou recognized, however, that sustainable transformation required cultural change. In 2018, the Corporate Culture Reshaping Project engaged over 26,000 employees, embedding a new philosophy: “Every Individual Matters, Every Bottle Shines.” This approach was integrated into performance evaluations, leadership development, and daily operations, creating alignment throughout the organization.

By 2021, CR Beer had a leaner operational structure and a culturally empowered workforce, setting the stage for its brand reinvention.

然而,侯孝海認(rèn)識(shí)到,可持續(xù)的變革需要文化的變革。2018年,企業(yè)文化改造項(xiàng)目覆蓋了2.6萬(wàn)多名員工,嵌入了一種新的理念:“每一個(gè)人都不簡(jiǎn)單,每一瓶酒才放光彩。”這種方法被整合到績(jī)效評(píng)估、領(lǐng)導(dǎo)力發(fā)展和日常操作中,在整個(gè)組織中創(chuàng)建了一致性。

到2021年,華潤(rùn)啤酒的組織結(jié)構(gòu)更精簡(jiǎn),文化認(rèn)同度更高,為其品牌重塑奠定了基礎(chǔ)。

Reinventing the Brand: Capturing the New Generation

Following structural reforms, CR Beer turned its attention to brand innovation and premiumization. Recognizing younger consumers sought meaningful experiences, Hou led a comprehensive rebranding under the banner “We made for young.”

Central to this strategy was the revitalization of Yongchuang Tianya SuperX, positioned to resonate strongly with youth culture. CR Beer invested significantly in influencer marketing, music festivals, and high-profile events like the XGames, deeply embedding SuperX into China's dynamic lifestyle scene. The results were swift and impressive—sales targets quickly doubled, affirming CR Beer's ability to dominate the premium segment and engage a new generation of consumers.

品牌重塑:抓住新生代

經(jīng)過(guò)結(jié)構(gòu)改革,華潤(rùn)啤酒將注意力轉(zhuǎn)向品牌創(chuàng)新和高端化。認(rèn)識(shí)到年輕消費(fèi)者尋求有意義的體驗(yàn),侯孝海在“We made for young”的旗幟下領(lǐng)導(dǎo)了一次全面的品牌重塑。

這一戰(zhàn)略的核心是振興勇闖天涯SuperX,使其能夠與青年文化產(chǎn)生強(qiáng)烈共鳴。華潤(rùn)啤酒在網(wǎng)紅營(yíng)銷、音樂(lè)節(jié)和XGames等知名活動(dòng)上投入了大量資金,將SuperX深深融入到中國(guó)充滿活力的生活環(huán)境中。結(jié)果是迅速而令人印象深刻——銷售目標(biāo)迅速翻了一番,進(jìn)一步肯定了華潤(rùn)啤酒主導(dǎo)高端市場(chǎng)并吸引新一代消費(fèi)者的能力。

Strategic Partnership with Heineken: Accelerating Premiumization

As CR Beer focused on developing its premium portfolio, Hou saw an opportunity to accelerate growth through a global alliance.

“Rather than exporting Chinese beer, we should first bring in top international brands, collaborate, and refine our approach,” he explained, setting the stage for CR Beer’s next major move.

In 2018, CR Beer forged a long-term strategic partnership with Heineken, securing exclusive distribution rights for Heineken products across Mainland of China, Hong Kong, and Macau. Under the agreement, Heineken acquired a 20.7% stake in CR Beer, while CR Beer took a 0.9% stake in Heineken Group.

與喜力的戰(zhàn)略合作伙伴關(guān)系:加速高端化

隨著華潤(rùn)啤酒專注于開(kāi)發(fā)其高端產(chǎn)品組合,侯孝海看到了通過(guò)聯(lián)合國(guó)際品牌加速增長(zhǎng)的機(jī)會(huì)。

他解釋說(shuō):“與其輸出中國(guó)品牌,我們更應(yīng)該首先引進(jìn)頂級(jí)國(guó)際品牌,通過(guò)合作來(lái)完善我們的打法”,這為華潤(rùn)啤酒的下一個(gè)重大舉措奠定了基礎(chǔ)。

2018年,華潤(rùn)啤酒與喜力建立了長(zhǎng)期的戰(zhàn)略合作伙伴關(guān)系,確保了喜力產(chǎn)品在中國(guó)大陸、香港和澳門的獨(dú)家分銷權(quán)。根據(jù)協(xié)議,喜力收購(gòu)了華潤(rùn)啤酒20.7%的股份,而華潤(rùn)啤酒則收購(gòu)了喜力集團(tuán)0.9%的股份。

This partnership immediately strengthened CR Beer’s position in the premium segment, leveraging Heineken’s global reputation and integrating its products into CR Beer’s extensive distribution network. For Heineken, the agreement provided a significant re-entry into the Chinese market, where its share had fallen to just 0.4% by 2017. By the end of 2023—the final year of their first five-year plan post-merger—Heineken’s sales in China reached 600,000 tons, a fourfold increase, making China Heineken’s second-largest global market.

Building on this momentum, CR Beer introduced the “4+4” brand matrix, blending four domestic brands - Yongchuang Tianya SuperX, Marrs Green, Craftsmanship, and Flower Face with four international brands - Heineken, Red Baron, Tiger, and SOL. This balanced strategy effectively addressed diverse consumer segments, reinforcing CR Beer’s position in China's premium beer market.

這一合作伙伴關(guān)系很快加強(qiáng)了華潤(rùn)啤酒在高端領(lǐng)域的地位,利用了喜力的全球聲譽(yù),并將其產(chǎn)品整合到華潤(rùn)啤酒廣泛的分銷網(wǎng)絡(luò)中。對(duì)喜力來(lái)說(shuō),該協(xié)議將顯著地提升在中國(guó)市場(chǎng)銷量,到2017年,喜力在中國(guó)市場(chǎng)的市場(chǎng)份額已經(jīng)降至0.4%。

到2023年底,即合并后第一個(gè)五年計(jì)劃的最后一年,喜力在中國(guó)的銷量達(dá)到60萬(wàn)噸,增長(zhǎng)了四倍,使中國(guó)成為喜力的第二大全球市場(chǎng)。

基于這一勢(shì)頭,華潤(rùn)啤酒推出了“4+4”品牌矩陣,融合了四大國(guó)內(nèi)品牌——勇闖天涯SuperX、馬爾思綠、匠心營(yíng)造和臉譜,以及喜力、紅爵、Tiger和蘇爾。這種平衡的策略有效地解決了不同消費(fèi)者群體的需求,強(qiáng)化了華潤(rùn)啤酒在中國(guó)優(yōu)質(zhì)啤酒市場(chǎng)的地位。

Figure 2. CR Beer’s 4+4 Brand Matrix 圖2:華潤(rùn)啤酒4+4品牌矩陣

Source: CR Beer, IMD China 來(lái)源:華潤(rùn)啤酒,IMD中國(guó)

Beyond Beer: CR Beer’s Bet on Baijiu

Having navigated multiple economic cycles—expansion, market saturation, and fluctuating demand—CR Beer recognized the necessity to Limited diversification beyond beer. In 2020, the company established CR Liquor, a wholly owned subsidiary, signaling a strategic move into the high-margin Baijiu market. Through targeted acquisitions, CR Beer secured significant stakes in prominent Baijiu producers—40% in Shandong Jingzhi, 49% in Anhui Jinzhongzi, and 55.19% in Guizhou Jinsha Jiaojiu—between 2021 and 2022.

多元發(fā)展: 華潤(rùn)啤酒投資白酒領(lǐng)域

在穿越了多個(gè)經(jīng)濟(jì)周期——擴(kuò)張、市場(chǎng)飽和和需求波動(dòng)之后——華潤(rùn)啤酒認(rèn)識(shí)到在啤酒之外實(shí)現(xiàn)有限多元化的必要性。2020年,該公司成立了全資子公司華潤(rùn)酒業(yè),標(biāo)志著其向高利潤(rùn)白酒市場(chǎng)的戰(zhàn)略進(jìn)軍。通過(guò)有針對(duì)性的收購(gòu),華潤(rùn)啤酒在2021-2022年期間獲得了知名白酒生產(chǎn)商的大量股份——山東景芝白酒40%股權(quán),安徽金種子酒業(yè)49%股權(quán),貴州金沙窖酒55.19%股權(quán)。

By employing a dual empowerment strategy, CR Beer effectively integrated its beer and Baijiu businesses, capitalizing on synergies across distribution, operations, and branding. This strategic alignment reinforces the company’s position in the premium alcohol sector and supports its ambitious vision of "leading the new world of beer" and "exploring the new world of Baijiu."

With industry giants Moutai and Wuliangye dominating Baijiu, CR Beer faces intense competition. However, if its beer transformation is any indication, the company is well-positioned to make its mark.

通過(guò)采用啤白雙賦能戰(zhàn)略,華潤(rùn)啤酒有效地整合了其啤酒和白酒業(yè)務(wù),利用了分銷、營(yíng)運(yùn)和品牌之間的協(xié)同效應(yīng)。這種戰(zhàn)略結(jié)合加強(qiáng)了該公司在高端白酒行業(yè)的地位,并支持了其“引領(lǐng)啤酒新世界”和“探索白酒新世界”的愿景。

隨著行業(yè)巨頭茅臺(tái)和五糧液開(kāi)始主導(dǎo)白酒市場(chǎng),華潤(rùn)啤酒面臨著激烈的競(jìng)爭(zhēng)。然而,按照其啤酒業(yè)務(wù)的轉(zhuǎn)型經(jīng)驗(yàn),該公司完全有能力在白酒市場(chǎng)有所作為。

Delivering Results: A Transformation That Paid Off

By 2024, CR Beer’s strategic transformation was delivering clear, measurable results. As the company celebrated its 30th anniversary, it showcased not just longevity, but successful reinvention. Premium beer sales volume surged, with Heineken up nearly 20%, Lao Xue and Amstel sales doubling, and ultra-premium brand Nong Li increasing by 35%. From 2020 to 2024, CR Beer’s total revenue grew by 22.85%, and net profit soared by 126.3%. Additionally, its beer market share increased, with premium beer sales reaching 2.5 million tons, positioning the company among the industry leaders.

交付結(jié)果:一場(chǎng)成果豐碩的變革

到2024年,華潤(rùn)啤酒的戰(zhàn)略轉(zhuǎn)型取得了清晰、可衡量的結(jié)果。在該公司慶祝成立30周年之際,它不僅展示了其持久的生命力,還展示了成功的變革。高端啤酒銷量飆升,喜力增長(zhǎng)近20%,老雪和紅爵銷量翻倍,超高端品牌醲醴增長(zhǎng)35%。2020年至2024年,華潤(rùn)啤酒的總收入增長(zhǎng)了22.85%,凈利潤(rùn)飆升了126.3%。此外,其啤酒市場(chǎng)份額有所增加,高檔銷量達(dá)到250萬(wàn)噸,使該公司躋身行業(yè)領(lǐng)導(dǎo)者之列。

CR Beer’s expansion into Baijiu also gained significant momentum, generating RMB 2.149 billion in revenue, driven by a 35% increase in sales of its flagship product, Zhaiyao, which accounted for over 70% of Baijiu revenues.

For Hou Xiaohai, these results solidified his industry standing. His strategic vision and execution earned him the 2024 Ram Charan Management Practice Award for Transformational CEOs and recognition in the Leaders 50 Global Business Leaders list. His leadership approach became a benchmark for driving transformative change.

華潤(rùn)啤酒向白酒領(lǐng)域的擴(kuò)張也獲得了顯著的勢(shì)頭,收入為21.49億元,這得益于其旗艦產(chǎn)品摘要的銷售額增長(zhǎng)35%,占白酒收入的70%以上。

對(duì)于侯孝海來(lái)說(shuō),這些結(jié)果鞏固了他的行業(yè)地位。他的戰(zhàn)略愿景和執(zhí)行為他贏得了“2024拉姆·查蘭管理實(shí)踐獎(jiǎng)-變革型CEO”,并在Leaders 50全球商業(yè)領(lǐng)袖名單中獲得認(rèn)可。他的領(lǐng)導(dǎo)方式成為了推動(dòng)變革的基準(zhǔn)。

As CR Beer moves into the final phase of its “3+3+3” strategy in 2025, chairman Hou Xiaohai introduced the “Three Precision” model—emphasizing a streamlined organizational structure, rigorous cost optimization, and operational excellence. This new model is designed to sharpen the company’s competitive edge, enhance profitability, and drive sustainable growth in an increasingly challenging market.

With this strategic focus, the crucial question now is whether CR Beer can replicate its successful beer transformation in China’s fiercely competitive Baijiu market.

隨著華潤(rùn)啤酒在2025年進(jìn)入“3+3+3”戰(zhàn)略的最后階段,董事會(huì)主席侯孝海推出了“三精管理”模式——強(qiáng)調(diào)精簡(jiǎn)的組織結(jié)構(gòu)、精益成本優(yōu)化和精細(xì)業(yè)務(wù)操作。這種新模式旨在提高公司的競(jìng)爭(zhēng)優(yōu)勢(shì),提高盈利能力,并在一個(gè)日益具有挑戰(zhàn)性的市場(chǎng)中推動(dòng)可持續(xù)增長(zhǎng)。

有了這一戰(zhàn)略焦點(diǎn),現(xiàn)在的關(guān)鍵問(wèn)題是,華潤(rùn)啤酒能否在中國(guó)競(jìng)爭(zhēng)激烈的白酒市場(chǎng)復(fù)制其成功的啤酒業(yè)務(wù)轉(zhuǎn)型。

Business Lessons: Key Takeaways for Global Leaders

CR Beer’s transformation provides key insights for business leaders managing market shifts and disruptions:

Transformation takes time and discipline – Sustainable transformation requires a solid foundation and a long-term perspective.

Culture and people matter as much as strategy – Structural adjustments alone fall short without cultural alignment. Engaging employees and aligning them with the vision ensures lasting change.

Digital readiness is vital – Investments in technology, digital marketing, and e-commerce enable swift adaptation to evolving consumer preferences, particularly among younger demographics.

Strategic partnerships accelerate growth – Well-chosen alliances can significantly accelerate entry into new market segments, emphasizing the value of strategic collaborations.

Diversification is a calculated risk – CR Beer’s expansion into Baijiu highlights the potential benefits and risks of strategic diversification.

CR Beer’s journey is more than a turnaround—it exemplifies strategic foresight, meticulous execution, and bold adaptability.

商業(yè)課程:對(duì)全球領(lǐng)導(dǎo)者的關(guān)鍵收獲

華潤(rùn)啤酒的轉(zhuǎn)型為商業(yè)領(lǐng)袖應(yīng)對(duì)市場(chǎng)變遷與行業(yè)顛覆提供了關(guān)鍵啟示:

轉(zhuǎn)型需要時(shí)間和紀(jì)律——可持續(xù)的轉(zhuǎn)型需要一個(gè)堅(jiān)實(shí)的基礎(chǔ)和一個(gè)長(zhǎng)期的視角。

文化和組織和戰(zhàn)略一樣重要——如果沒(méi)有文化一致性,結(jié)構(gòu)調(diào)整就不夠。吸引員工,并使他們與愿景保持一致,以確保了持久的改變。

數(shù)智化至關(guān)重要——對(duì)技術(shù)、數(shù)字營(yíng)銷和電商的投資能夠迅速適應(yīng)不斷變化的消費(fèi)者偏好,特別是在年輕人群中。

戰(zhàn)略伙伴關(guān)系加速增長(zhǎng)——精心選擇的戰(zhàn)略伙伴可以顯著加速進(jìn)入新的細(xì)分市場(chǎng),這強(qiáng)調(diào)戰(zhàn)略合作的價(jià)值。

多元化發(fā)展是一種經(jīng)過(guò)計(jì)算的風(fēng)險(xiǎn)——華潤(rùn)啤酒向白酒的擴(kuò)張突出了戰(zhàn)略多樣化的潛在好處和風(fēng)險(xiǎn)。

華潤(rùn)啤酒的旅程不僅僅是一次變革——它體現(xiàn)了戰(zhàn)略遠(yuǎn)見(jiàn)、細(xì)致的執(zhí)行和大膽的適應(yīng)性。

瑞士IMD國(guó)際管理發(fā)展學(xué)院成立于1946年,總部位于瑞士洛桑,在新加坡設(shè)立了亞洲校區(qū),在深圳和開(kāi)普敦設(shè)有分部。作為全球頂尖商學(xué)院,每年有120 多個(gè)國(guó)家的 19,000 多名高管在此學(xué)習(xí),2,000 多家組織委托其培養(yǎng)領(lǐng)導(dǎo)人才。并在全球180多個(gè)國(guó)家擁有超145,000名校友構(gòu)建起強(qiáng)大人脈網(wǎng)絡(luò)。2024 年,IMD的公開(kāi)課和定制課程均躋身全球前十。其 MBA項(xiàng)目表現(xiàn)卓越,在彭博社2024 - 2025年度排名中居歐洲第一,在Poets&Quants 2024 - 2025 年、2025 年《金融時(shí)報(bào)》排名中也名列前茅。2024 年,IMD的EMBA項(xiàng)目在《金融時(shí)報(bào)》排名中,歐洲第8、全球第17,多項(xiàng)標(biāo)準(zhǔn)位居前列。

2024年,正值華潤(rùn)啤酒30周年之際,瑞士IMD國(guó)際管理發(fā)展學(xué)院就華潤(rùn)啤酒“組織變革”工作開(kāi)發(fā)商業(yè)案例《華潤(rùn)啤酒:厲兵秣馬,備戰(zhàn)未來(lái)》,系統(tǒng)性研究華潤(rùn)啤酒于“商業(yè)新世界”中,在戰(zhàn)略、組織、文化等方面的變革。本期內(nèi)容轉(zhuǎn)自IMD官網(wǎng)《華潤(rùn)啤酒的大膽賭注——為中國(guó)最大的啤酒釀造商重塑未來(lái)》

免責(zé)聲明:市場(chǎng)有風(fēng)險(xiǎn),選擇需謹(jǐn)慎!此文僅供參考,不作買賣依據(jù)。

關(guān)鍵詞:

營(yíng)業(yè)執(zhí)照公示信息

營(yíng)業(yè)執(zhí)照公示信息